The following table shows Alex's estimated annual benefits of holding different amounts of money.Average moneyholdings($)Total benefit($)700508005990066100071110074How much money will Alex hold if the nominal interest rate is 4 percent? (Assume she wants her money holdings to be in multiples of $100.)

A. $800

B. $700

C. $900

D. $1,000

Answer: D

You might also like to view...

Refer to Figure 13-18. The diagram demonstrates that

A) in the long run, the monopolistic competitor produces the minimum-cost output level, Qa, but in the short run its output of Qb is not cost minimizing. B) it is possible for a monopolistic competitor to produce the productively efficient output level, Qa, if it is willing to lower its price from Pb to Pa. C) in the short run, the monopolistic competitor produces an output Qb but in the long run after it adjusts its capacity, it will produce the allocatively efficient output, Qa. D) it is not possible for a monopolistic competitor to produce the productively efficient output level, Qa, because of product differentiation.

Under a progressive income tax, the average tax rate

A. decreases as income increases. B. remains constant at all levels of income. C. increases as income increases. D. initially decreases, then increases, as income increases.

The actual money multiplier multiplied by the change in total reserves is the

A. discount rate. B. actual change in the money supply. C. federal funds rate. D. potential money multiplier.

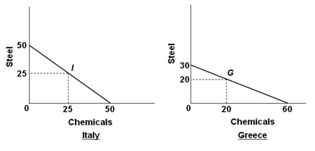

Refer to the graphs and information below. The assumption made about the domestic production opportunity costs in both countries is that they are:

Suppose the world economy is composed of just two countries: Italy and Greece. Each can produce steel or chemicals, but at different levels of economic efficiency. The production possibilities curves for the two countries are shown in the graphs below.

A. Constant

B. Variable

C. Increasing

D. Decreasing