The Boston Consulting Group Matrix helps managers evaluate their strategy alternatives for the entire business portfolio.

Answer the following statement true (T) or false (F)

True

One of the most popular techniques for analyzing a corporation's strategy for managing its portfolio is the BCG matrix. It is a tool that can, along with other techniques, help managers of the firm as a whole and of its individual businesses evaluate their strategy alternatives.

You might also like to view...

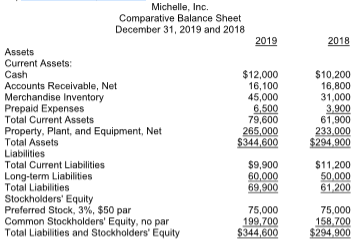

Prepare a horizontal analysis of the comparative balance sheet of Michelle, Inc. (Round to one decimal place.)

Data for Michelle, Inc. follow:

Answer the following statements true (T) or false (F)

1. Most of the time when service failures occur, the people part of the delivery system has succeeded, but other aspects were unsatisfactory. 2. Hospitality organizations should not admit liability for unfortunate, unavoidable occurrences that are not its fault, but they should do everything in their power to rectify such situations. 3. The main reason for empowering servers to provide on-the-spot service recovery is to keep dissatisfied customers from leaving that way. 4. An evangelist is created by exceeding expectations. 5. No matter how the recovery is handled, the original failure is always more important to the company.

The principle objective in cash management is to minimize your cash balances while maintaining adequate liquidity

Indicate whether the statement is true or false.

For questions 1 through 6:Indicate how each event affects the financial statements model. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.Increase = I Decrease = D No Effect = NA(Note that "No Effect" means that the event does not affect that element of the financial statements or that the event causes an increase in that element, which is offset by a decrease in that same element.)Amity Co. signed contracts for $25,000 of services to be performed in the future.AssetsLiabilitiesEquityRevenuesExpensesNet IncomeStmt of Cash Flows???????

What will be an ideal response?