Suppose a single-parent father with four children receives these welfare benefits from the government each month: $400 in cash, $200 in food stamps, and $100 in medical benefits

If the father takes a job paying $1000 per month he will lose all these benefits and will also pay $100 in income and social security taxes. His earnings from the job are consequently being taxed at an effective marginal rate of A) 80%.

B) 60%.

C) 40%.

D) 20%.

E) 10%.

A

You might also like to view...

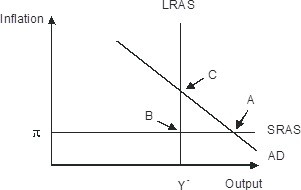

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Why would a member of a cartel cheat?

What will be an ideal response?

Which of the following is true?

A. A nation cannot have a comparative advantage in the production of every good. B. A nation cannot have an absolute advantage in the production of every good. C. A nation can have a comparative advantage in the production of every good, but not an absolute advantage. D. A nation can have a comparative advantage in the production of a good only if it also has an absolute advantage.

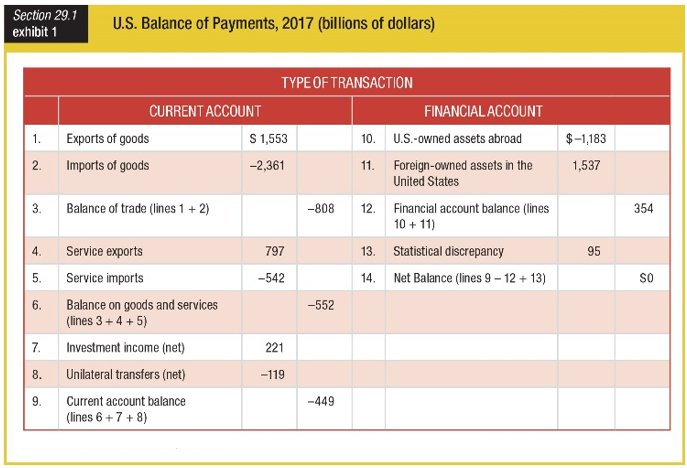

What was the difference between service exports and service imports in 2017?

a. $797 billion

b. $542 billion

c. $255 billion

d. -$255 billion