Insurance companies create wealth by

a. reducing the amount of risk that the risk averse must bear

b. reducing the amount of risk that risk lovers must bear

c. increasing the amount of risk that the risk averse must bear

d. increasing the amount of risk that risk lovers must bear

a

You might also like to view...

What is meant by the term "marginal analysis"? Suppose an individual has to choose between renting four apartments at different distances from his place of work

The individual has to commute to work on five days of the week and as such will require different quantities of gasoline depending on the apartment he decides to rent. The monthly rents and expected gasoline consumption from each of the apartments is shown in the table below. If the price of gasoline is $5 per gallon, using marginal analysis, determine the optimum choice for the individual. Which principal is used for this optimization? What does it state? Apartment Gasoline Consumption (gallons per month) Rent ($ per month) 1 5 1,100 2 10 1,000 3 15 960 4 20 940

Unplanned inventory reduction causes firms to:

a. produce less output. b. lower prices on the products it sells. c. change its promotional strategies. d. produce more output.

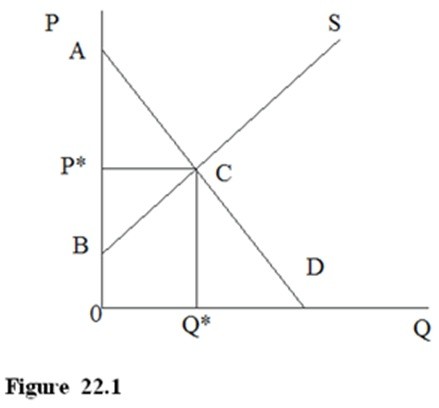

In Figure 23.1, for a good with no externality, which area represents the total value to the consumer?

A. 0BCQ* B. BP*C C. 0ACQ* D. 0P*CQ*

Table 17.1 YearReal GDPPopulation1$575 billion22 million2$580 billion24 million3$605 billion25 million4$606 billion27 millionRefer to Table 17.1. GDP per capita in year 1 was

A. $26.136 billion. B. $26,136.36. C. $26.136 million. D. $261,363.63.