Briefly explain how a change in the personal income tax rate affects aggregate demand

What will be an ideal response?

Changes in the personal income tax rate affect aggregate demand through consumption. Consumption is a major component of aggregate demand. For example, a decrease in the personal income tax rate increases disposable income, which in turn increases consumption.

You might also like to view...

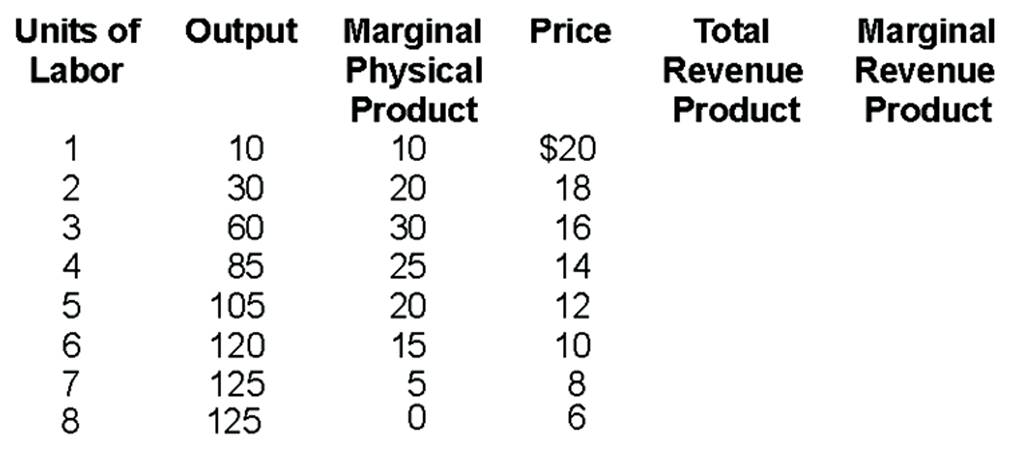

This producer

A. is a perfect competitor.

B. is an imperfect competitor.

C. could be either a perfect or imperfect competitor.

An open peg might be an option for some nations that desire to:

A) close off capital inflows and outflows and fix currency rates. B) allow the free flow of capital and fix currency rates. C) allow the free flow of capital with flexible currency rates. D) close off capital inflows and outflows with flexible currency rates.

Janet prefers to implement a public policy that can save 100 people out of 1,000 people than a policy that has a 10% chance of saving 1,0000 people. Once can say that Janet's preferences

A) do not support the expected utility theory. B) are not rational. C) are not complete. D) are not risk neutral.

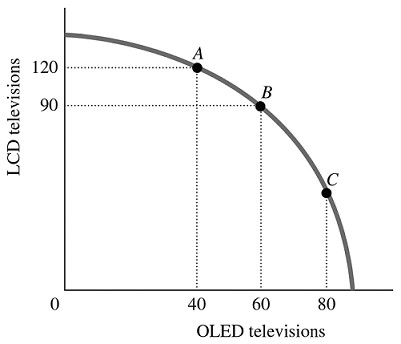

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

A. more than 30. B. exactly 60. C. fewer than 30. D. exactly 30.