Suppose that the exchange rate between Canadian dollars and U.S. dollars is $0.60 U.S. dollars per Canadian dollar. If the exchange rate goes to $0.50 U.S. dollars per Canadian dollar, it would tend to:

a. increase U.S. exports to Canada

b. decrease U.S. exports to Canada.

c. increase Canadian exports to the United States.

d. both (b) and (c)

d

You might also like to view...

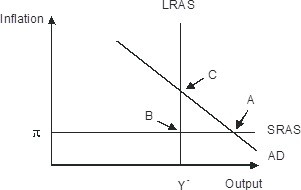

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

What market structures other than oligopoly have the characteristic of one firm's actions affecting the actions of its competitors? Explain your answer

What will be an ideal response?

Refer to the above figure. The firm is operating using MRP0. An increase in productivity has occurred. The relevant curve for the firm after the increase in productivity

A) is MRP0. B) is MRP1. C) is MRP2. D) could be MRP1 or MRP2 depending upon whether the firm was earning a positive profit.

Securitization is the process by which financial institutions

A) pool together a group of loans and then issue securities backed by the pool. B) determine the composition of their assets that will yield the optimal amount of security for their financial health. C) borrow funds from the Federal Reserve and then use those funds to make loans to their customers. D) determine sub-prime mortgage rates.