The total burden of a tax is the

A. absolute number of dollars an individual pays.

B. percentage of income a person pays.

C. number of dollars a person must be given after taxation to make him as well off as he was before taxation.

D. revenue lost to loopholes.

Answer: C

You might also like to view...

It the marginal social benefit from contributions to charities is the same for all individuals who give to charities, then allowing individuals to deduct charitable contributions from their income taxes cannot serve as a Pigouvian subsidy under a progressive income tax system.

Answer the following statement true (T) or false (F)

Under the Texas law known as "rule of capture," land owners "get to pump as much of the water under it as they want. . .. 'This means whoever sucks it out first, it's their water'-even if that means there isn't enough left for others." Under this law, pumping large amounts of water:

A. imposes a negative externality on others. B. imposes the free rider effect on others. C. imposes a positive externality on others. D. is a private decision with no effects on others.

Which of the following is the formula for marginal revenue?

a. MR = ?AR x ?q b. MR = ?AR ÷ ?q c. MR = ?TR ÷ ?q d. MR = ?TR x ?q

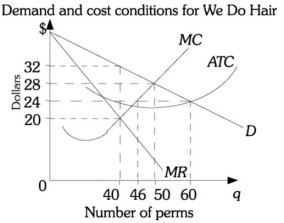

Refer to the information provided in Figure 15.2 below to answer the question(s) that follow.  Figure 15.2 Refer to Figure 15.2. From society's viewpoint, the ________ level of output is 50 perms.

Figure 15.2 Refer to Figure 15.2. From society's viewpoint, the ________ level of output is 50 perms.

A. shut down B. monopoly C. efficient D. minimum