Suppose a tax on sellers has been imposed in the graph shown. The amount of deadweight loss generated by this tax is:

A. $0.

B. $80.

C. $160.

D. $129.50

B. $80.

You might also like to view...

Countries with high real GDP tend to have ________ infant mortality rates and ________ literacy rates than countries with low real GDP.

A. lower; higher B. higher; higher C. higher; lower D. lower; lower

If the increase in government spending is $200 and the multiplier is 2.5, then the change in real gross domestic product will be _____

a. $200 b. $300 c. $500 d. $700

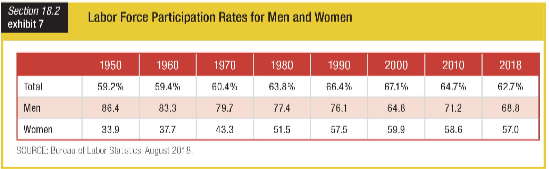

Which of the following is true of labor force participation rates?

a. In 2000, 64.8% of all workers were men.

b. In 1950, 33.9% of all workers were women.

c. In 2000, labor force participation for men fell for the first time.

d. In 2010, labor force participation for women fell for the first time.

Answer the following questions true (T) or false (F)

1. The Federal Reserve can combat an inflationary gap in the economy by buying government securities in the nation's capital markets. 2. An increase in aggregate demand in the normal range of the economy's aggregate supply curve will increase the general price level in the economy. 3. The goal of macroeconomic policy is to combat inflationary and recessionary gaps which exist in the nation's money market.