What structures make up the international capital markets?

A) stock market, IFM, and the World bank

B) bond market, foreign exchange rates, IFM, and the World bank

C) commercial banks, corporations, non-bank financial institutions, the central banks, and other government agencies

D) commercial banks and corporations

E) the central banks and non-bank financial institutions

C

You might also like to view...

The difference between inventories and inventory investment is that typically ________

A) the first one is a stock of unfinished or unsold goods; the second one is a flow that indicates productive activity B) the first one denotes the change in holdings of capital; the second one includes most final goods C) the first one is measured at the beginning of the year; the second one is measured at the end of the year D) all of the above E) none of the above

Excess reserves are important to bankers because:

a. They are typically deposited in special high-yielding investment accounts. b. They represent the funds that can be used to acquire income-producing assets, such as loans and securities. c. They indicate the profits that are divided among the financial institution's owners. d. They indicate profitable banking practices. e. If they are not maintained, banking regulators may shut down the bank.

The short-run Phillips curve holds that

A) high inflation and high unemployment can occur together. B) low inflation and low unemployment can occur together. C) high inflation and low unemployment can occur together. D) b and c

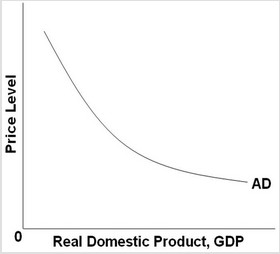

Use the following graph to answer the next question. Which of the following factors does NOT explain a movement along the AD curve?

Which of the following factors does NOT explain a movement along the AD curve?

A. The real-balances effect B. The foreign purchases effect C. The expenditure multiplier effect D. The interest-rate effect