A tax that exacts a higher proportion of income from higher-income people than it does from lower-income households is a regressive tax.

Answer the following statement true (T) or false (F)

False

You might also like to view...

The basic economic problem of scarcity

A) is a problem only in developing economies. B) does not apply to the wealthy in society. C) has always existed and will continue to exist. D) will eventually disappear as technology continues to advance.

In international trade, an infant industry is one:

a. that protects firms that produce products for infants. b. with a large number of very small firms. c. in which the firms are experiencing very small profits. d. in the early stages of its development.

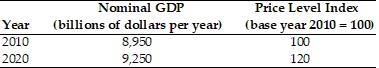

Using the data in the above table, what is the real GDP for year 2020 (in billions of constant dollars)?

Using the data in the above table, what is the real GDP for year 2020 (in billions of constant dollars)?

A. 9,250 B. 7,708 C. 8,950 D. 8,500

Starting from long-run equilibrium, a large increase in government purchases will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; higher; potential B. recessionary; higher; potential C. recessionary; lower; lower D. expansionary; higher; higher