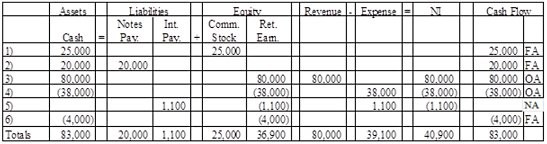

Osage Corporation began business operations and experienced the following transactions during Year 1:1) Issued common stock for $25,000 cash2) Issued a $20,000, 6% 4-year note to the bank on February 13) Provided services to customers for $80,000 cash4) Paid $38,000 for operating expenses5) Accrued interest expense on the note6) Paid a $4,000 dividend to shareholdersRequired:Record the above transactions on a horizontal financial statements model to reflect their effect on Osage's financial statements. In the last column, enter OA, IA, FA for the type of cash flow activity, or NA if there is no activity.

What will be an ideal response?

Accrued Interest Expense = $20,000 note × 6% interest rate = $1,200 accrued interest per year / 12 months = $100 of interest accrues per month.

$100 per month × 11 months (Feb through Dec) = $1,100 accrued interest expense

You might also like to view...

Which of the following best describes the term "expenses"?

a. The amount of total profits earned by a business since it began operations. b. The amount of interest or claim that the owners have in the business. c. The future economic resources of a business entity. d. The outflow of assets resulting from the sale of goods and services.

Assuming that Ska's cost of equity capital is 14% and it expects to grow earnings at a rate of 8% per year, we would expect Ska's P/E ratio to be

a. 8 b. 16.7 c. 14 d. 4.5

Regardless of the inventory costing system used, cost of goods available for sale must be allocated at the end of the period between

A. net purchases during the period and ending inventory. B. beginning inventory and cost of goods sold. C. ending inventory and beginning inventory. D. beginning inventory and net purchases during the period. E. ending inventory and cost of goods sold.

What are the three categories of control frequencies and how often are they used?

What will be an ideal response?