According to the life-cycle hypothesis,

A) the present value of lifetime consumption equals the future value of lifetime income.

B) the income earned in a lifetime will be evenly divided between consumption and saving.

C) household consumption depends on income that households expect to receive each year, and financial markets are used to smooth consumption in response to changes in transitory income.

D) households use financial markets to transfer funds from periods when income is high to periods when income is low.

D

You might also like to view...

Distinguish between a perfectly competitive firm and a monopolistically competitive firm on the basis of the long-run equilibrium price

What will be an ideal response?

In a competitive market, an efficient allocation of resources is characterized by

a. a price greater than the marginal cost of production. b. the possibility of further mutually beneficial transactions. c. the largest possible sum of consumer and producer surplus. d. a value of consumer surplus equal to that of producer surplus.

With a negative income tax, the larger the difference between the break-even income level and the guaranteed level,

a. the greater the tax rate (by definition). b. the greater the incentive to work. c. the smaller the number of people eligible to receive benefits. d. the more inequitable the resulting distribution of income will be.

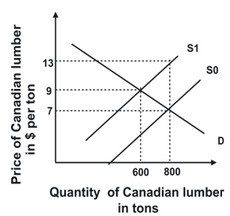

Refer to the graph shown. With a tariff on lumber imported from Canada of $6 per ton, the revenue the government would collect from the import of lumber would be:

A. $3,600. B. $4,800. C. $4,200. D. $0.