Consider a downward-sloping demand curve. When the price of a normal good increases, the income and substitution effects

A) work in the same direction to increase quantity demanded.

B) work in the same direction to decrease quantity demanded.

C) work in opposite directions and quantity demanded increases.

D) work in opposite directions and quantity demanded decreases.

B

You might also like to view...

An impartial observer who attempts to settle disagreements by listening to both sides separately and making suggestions is called a(n)

a. collective bargaining agent b. arbitrageur c. mediator d. binding negotiator e. judge

In Table 13-1, the Federal Reserve System has

a. sold $10 million in government securities to banks, taking payment in cash. b. sold $10 million in government securities to banks, taking payment from the bank's reserves. c. purchased $10 million in government securities from banks, paying for them with increases in banks' reserves. d. purchased $10 million in government securities from banks, paying for them with new Federal Reserve notes.

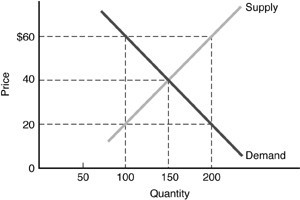

Refer to the above figure. If the government imposes a price ceiling of $60

Refer to the above figure. If the government imposes a price ceiling of $60

A. the quantity traded will be 150, and the price will be $60. B. the quantity traded will be 150, and the price will be $40. C. the quantity traded will be 100, and the price will be $60. D. the quantity traded will be 200, and the price will be $60.

Answer the following statements true (T) or false (F)

1. Rational expectations theory suggests that people make consistent forecasting errors regarding the effects of policy. 2. Mainstream economists contend that monetary policy tends to be destabilizing, in contrast to monetarists who believe that monetary policy is a stabilizing factor. 3. An efficiency wage is an above-market wage that spurs greater work effort and gives the firm more profits because of lower wage costs per unit of output. 4. The "efficiency wage" is one possible explanation for rigidities in the economy that leads to economic instability. 5. Monetarists recommend that the supply of money should be increased at a constant rate each year, proportionate with the long-run growth of real output.