How can a project manager support and encourage functional conflict?

A. By imposing a solution to the conflict after listening to each party

B. By negotiating a resolution by reasoning and persuasion

C. Conflict should not be encouraged or supported

D. By asking tough questions and by challenging the rationale behind recommendations

E. As soon as emotions flare, he or she can intervene and attempt to control conflict because it has become dysfunctional

Answer: D

You might also like to view...

With respect to the process of assigning the cost of postretirement benefits to periods of employee service, attribution period ends at

A) the expected retirement date. B) the actual retirement date. C) the full eligibility date. D) either a or b.

What are the issues associated with the infrastructure platform on which the ERP system will run?

What will be an ideal response?

It is illegal to use any pre-employment test that creates adverse impact

Indicate whether the statement is true or false.

X owns 70% of Y, which in turn owns 25% of Z. X, also owns 20% of Z. Which of the following statements is correct?

On January 1, 2018, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common shares and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively.

On January 1, 2019, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful

life was revised to 5 years on this date.

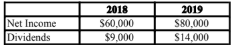

Marvin's net income and dividends for 2018 and 2019 are as follows:

Marvin's goodwill suffered an impairment loss of $5,000 during 2018. Hanson Inc. uses the equity method to account for its investment in Marvin Inc.

A) X has no control over Z.

B) X has indirect control over Z.

C) X has contingent control over Z.

D) X has direct control over Z.