A sum of $10,000 is deposited in a bank. Consider two situations: the bank offers an annual rate of interest of 10% and the bank offers an annual rate of interest of 15%. Compare the time value of money generated in both cases after:

a) one year.

b) five years.

a) At a rate of interest of 10% per annum, future value of $10,000 after a year is: $11,000. Hence, time value of money is: $11,000 - $10,000 = $1,000.

At a rate of interest of 15% per annum, future value of $10,000 after a year is: $11,500. Hence, time value of money is: $11,500 - $10,000 = $1,500.

b) At a rate of interest of 10% per annum, future value of $10,000 after five years is: $16,105.1. Hence, time value of money is: $16,105.1 - $10,000 = $ 6,105.1.

At a rate of interest of 15% per annum, future value of $10,000 after five years is: $20,113.57. Hence, time value of money is: $20,113.57 - $10,000 = $10,113.57.

You might also like to view...

Rapid growth in M2 is likely to lead to ________

A) low demand for labor B) high levels of inflation C) low levels of investment D) high real interest rates

A speculator in foreign exchange is a person who

a. buys foreign currency, hoping to profit by selling it at a higher exchange rate at some later date b. earns illegal profit by manipulating foreign exchange c. causes differences in exchange rates in different geographic markets d. simultaneously buys large amounts of a currency in one market and sells it in another market e. takes no risks in foreign currency exchanges

A reduction in the required reserve ratio has the instant effect of:

a. Increasing the monetary base. b. Increasing excess reserves. c. Increasing bank shareholders' equity. d. Increasing bank reserves. e. All of the above are correct.

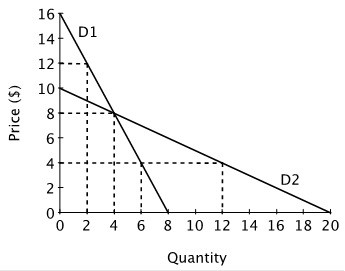

Refer to the figure below. When P = 4, the price elasticity of demand for the demand curve D1 is ________ and D2 is ________.

A. 1/3; 2/3 B. 2/3; 1/3 C. 3; 3 D. 1/3; 3