An increase in taxes will cause

A) a reduction in investment.

B) an increase in investment.

C) no change in investment.

D) no change in autonomous spending.

C

You might also like to view...

Before 2000, the three most recent U.S. recessions occurred in

A) 1969-1973, 1979-1982, and 1994-1995. B) 1973-1975, 1982-1985, and 1990-1991. C) 1973-1975, 1981-1982, and 1990-1991. D) 1981-1982, 1990-1991, and 1998-1999.

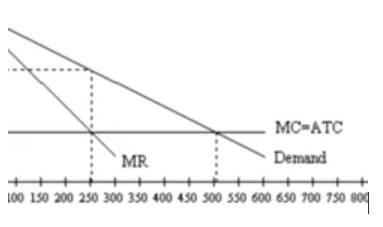

Refer to Figure 15-19. If the monopoly firm is not allowed to price discriminate, then consumer surplus amounts to

a. $3,125.

b. $1,562.50.

c. $0.

d. $6,250.

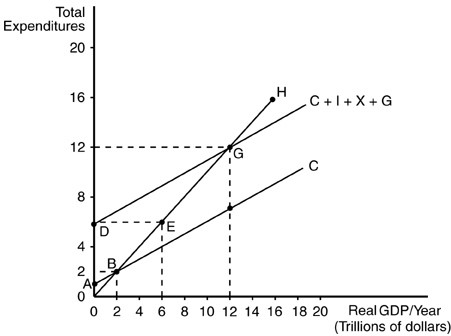

Refer to the above figure. If real Gross Domestic Product (GDP) is $6 trillion, then unplanned business inventories will

Refer to the above figure. If real Gross Domestic Product (GDP) is $6 trillion, then unplanned business inventories will

A. rise. B. fall. C. be equal to planned inventories. D. be zero.

The prominence of employer-provided health insurance in the U.S. has had the following major consequences, except:

A. Overuse of health-care services B. Rapidly rising prices of health care C. Reform efforts have mostly focused on regulation of health insurance D. Heightened awareness of employees about the true costs of their health care