The interest-rate-based approach to the monetary policy transmission mechanism says that a change in the money supply influences aggregate demand by

A) a change in interest rates, which changes investment.

B) a change in interest rates, which changes the money supply.

C) leading to shifts of the short-run aggregate supply curve.

D) changing consumer consumption behavior as they adjust to a change in the number of dollars available.

A

You might also like to view...

Level of economic prosperity

a. standard of living b. privatize c. economic system d. self-interest e. factor payments

Holding all else constant, a decrease in the real interest rate on Mexican assets will ________ the supply of dollars in the foreign exchange market and ________ the equilibrium Mexican peso/U.S. dollar exchange rate.

A. increase; decrease B. decrease; increase C. increase; increase D. decrease; decrease

How do financial institutions evaluate the creditworthiness of potential borrowers?

A. They do not evaluate creditworthiness because everyone is treated the same. B. They offer high interest rates because only the best borrowers will be able to afford them. C. They do not evaluate the creditworthiness because they know the borrower will honor his/her obligation to repay the loan. D. They gather information regarding the borrowers' finances.

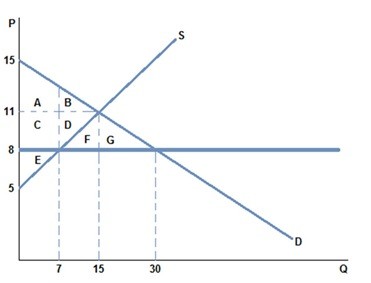

If a price ceiling of $8 were placed in the market in the graph shown:

If a price ceiling of $8 were placed in the market in the graph shown:

A. an excess supply of 23 would occur. B. an excess supply of 15 would occur. C. an excess supply of 7 would occur. D. None of these is true.