Jordan and Paul, a married couple, have taxable income of $85,475, which is taxed as follows: $19,050 × 10% =$1,905.00($77,400 - $19,050) × 12% = 7,002.00($85,475 - $77,400) × 22% = 1,776.50Total tax liability$10,683.50Their average tax rate is:

A. 10%.

B. 12.5%.

C. 12%.

D. 22%.

Answer: B

You might also like to view...

Northwest Lumber had a profit margin of 5.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. What was the firm's ROE?

A. 12.79% B. 13.47% C. 14.18% D. 14.88% E. 15.63%

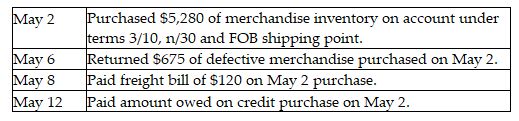

Journalize the following purchase transactions for Rocky's Swimming Pool Supply Company using the periodic inventory system. Explanations are not required.

A corporation originally issued $13 par value common stock for $15 per share. Which of the following is included in the entry to record the purchase of 300 shares of treasury stock for $11 per share?

A) Treasury Stock—Common is debited for $3300. B) Treasury Stock—Common is credited for $45. C) Retained Earnings is debited for $1650. D) Treasury Stock—Common is debited for $1650.

Online documents should include indexes especially if the document is _______________

a. in a foreign language b. complex and lengthy c. viewed by a large audience d. older