Describe the four determinants of exchange rates in the long run

What will be an ideal response?

One determinant of exchange rates in the long run is relative price levels between countries. If the price level in another country rises faster than the price level in the United States, then the value of the dollar will rise. Another determinant is the relative rates of productivity growth between countries. The country with the faster productivity growth will have the value of their currency rise. Another determinant is the preferences for domestic and foreign goods. An increase in the preferences for a country's goods will increase the value of its currency. Lastly, tariffs and quotas affect exchange rates. Higher tariffs and quotas lead to higher exchange rates.

You might also like to view...

Producer surplus

A. is the difference between the minimum price producers are willing to accept for a product and the higher equilibrium price. B. is the difference between the maximum price consumers are willing to pay for a product and the lower equilibrium price. C. rises as equilibrium price falls. D. is the difference between the maximum price consumers are willing to pay for a product and the minimum price producers are willing to accept.

While legislation enacted in 1998 granted the Bank of Japan new powers and greater autonomy, its critics contend that its independence is

A) limited by the Ministry of Finance's veto power over a portion of its budget. B) too great because it need not pursue a policy of price stability even if that is the popular will of the people. C) too great since the Ministry of Finance no longer has veto power over the bank's budget. D) limited since the Ministry of Finance can dismiss senior bank officials.

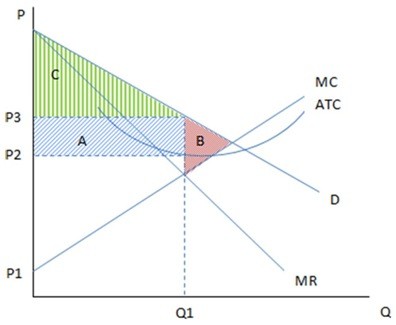

These are the cost and revenue curves associated with a monopolistically competitive firm. According to the graph shown, the monopolistically competitive firm:

According to the graph shown, the monopolistically competitive firm:

A. will earn negative profits (a loss) equal to area B. B. will earn positive profits equal to area C. C. will earn negative profits (a loss) equal to area A. D. will earn positive profits equal to area A.

In the long run, the corporate profits tax will lead to

A. lower profits in the corporate sector, but higher profits in the noncorporate sector. B. higher profits in the corporate sector, but lower profits in the noncorporate sector. C. higher profits in the corporate sector and higher profits in the noncorporate sector. D. lower profits in the corporate sector and lower profits in the noncorporate sector.