The deadweight loss from a tax is called the

A) marginal benefit of the tax.

B) marginal cost of the tax.

C) excess burden of the tax.

D) net gain from taxation.

E) net loss from taxation.

C

You might also like to view...

If increases in government spending lead to inflation, the value of the multiplier is reduced

a. True b. False Indicate whether the statement is true or false

A limitation on fiscal policy is time. Which of the following does not impact the timeliness of fiscal policy?

A. It takes time to recognize that the economy is in trouble. B. It will take time to develop a policy strategy and for Congress to pass it. C. All of these impact the timeliness of fiscal policy. D. It will take time for the policy to be implemented and for the many steps in the multiplier process to unfold.

Which of the following might be used to protect a monopoly from competition?

A.) A horizontal demand curve. B.) Marginal revenue. C.) A patent. D.) A contestable market.

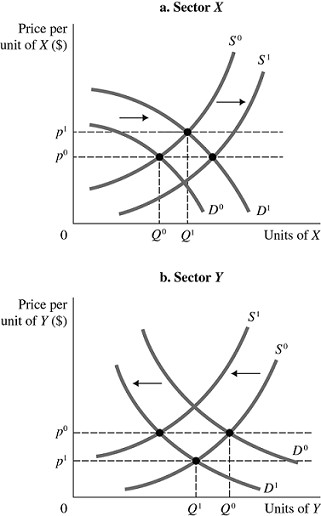

Refer to the information provided in Figure 12.4 below to answer the question(s) that follow. Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Assume consumer preference changes toward X and away from Y. Ceteris paribus, the likely change in capital flow in sector Y will cause the industry's short-run ________ curve to shift to the ________.

Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Assume consumer preference changes toward X and away from Y. Ceteris paribus, the likely change in capital flow in sector Y will cause the industry's short-run ________ curve to shift to the ________.

A. supply; left B. supply; right C. demand; right D. demand; left