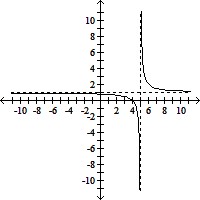

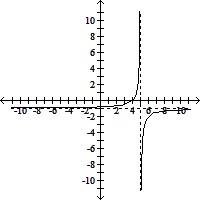

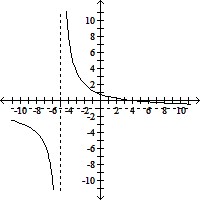

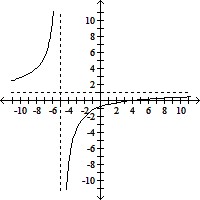

Graph the function.f(x) =

A.

B.

C.

D.

Answer: D

You might also like to view...

?Which of the following is not an example of a function? ?

A. ?You buy gas at the gas pump. x represents the number of gallons and y represents the cost of x gallons. B. ?Cookies are advertised for $2.50 each and coffee for $2.00 each. If you buy 3 cookies and spend a total of $9.5, how much did you spend for coffee? C. ?The amount of money you spend out of your wallet is related to the amount of money left in your wallet. D. ?The amount of calories you burn is related to your pulse rate. E. ?Shirts are advertised at $15 each. You buy x number of shirts.

Solve the problem.Suppose that the amount of oil pumped from a well decreases at the continuous rate of  per year. When, to the nearest year, will the well's output fall to one-eighth of its present value?

per year. When, to the nearest year, will the well's output fall to one-eighth of its present value?

A. 19 years B. 13 years C. 9 years D. 2 years

Solve the problem.Marianne is planning a shopping trip to buy birthday gifts for her son. She estimates that the total price of the items she plans to purchase will be between $350 and $400 inclusive. If sales are taxed at a rate of 8.375% in her area, what is the range of the amount of sales tax she should expect to pay on her purchases? If Marianne's budget for the shopping trip is $425, will she necessarily be able to buy all the gifts that she has planned?

A. $29.31 ? x ? $33.50, where x represents the amount of sales tax; Yes. B. $29.31 < x < $33.50, where x represents the amount of sales tax; Yes. C. $29.31 ? x ? $33.50, where x represents the amount of sales tax; No. D. $29.31 < x < $33.50, where x represents the amount of sales tax; No.

Find the tax refund or tax due for the following people. The letter following the name indicates the marital status. Assume a 52-week year and that all married people are filing jointly. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the tax rate schedule.

A. $685.96 due B. $2,662.22 due C. $2,662.22 refund D. $685.96 refund