Suppose there are five firms in the disposable diaper market. Hug-Me's share is 30 percent. Plumper's share is 30 percent. Drippy's share is 20 percent. Kool Kid's share is 10 percent. Nappomatic's share is 10 percent

The Herfindahl-Hirschman Index in this industry is A) 100.

B) 900.

C) 1,350.

D) 2,400.

D

You might also like to view...

Explain how the market can reduce the incentive for credit-rating firms to take advantage of conflicts of interest

What will be an ideal response?

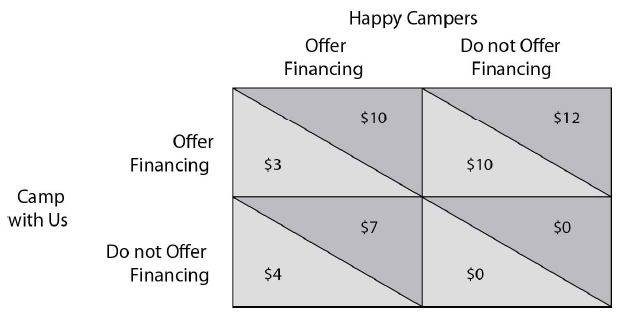

Refer to the payoff matrix below. If Camp with Us is known for consistently offering special financing and this is the focal point, what is the equilibrium of the game using the focal point criterion?

Camp with Us and Happy Campers compete in the market for campers. Each firm must decide each season if they are going to offer special financing or not. The above payoff matrix shows each firm's net economic profit at each pair of strategies.

A) Camp with Us Offer Financing and Happy Campers Do Not Offer Financing

B) Camp with Us Offer Financing and Happy Campers Offer Financing

C) Camp with Us Do Not Offer Financing and Happy Campers Do Not Offer Financing

D) Camp with Us Do Not Offer Financing and Happy Campers Offer Financing

In the above figure, through which range would the demand for this good be most inelastic?

A) A-B B) B-E C) E-F D) G-H

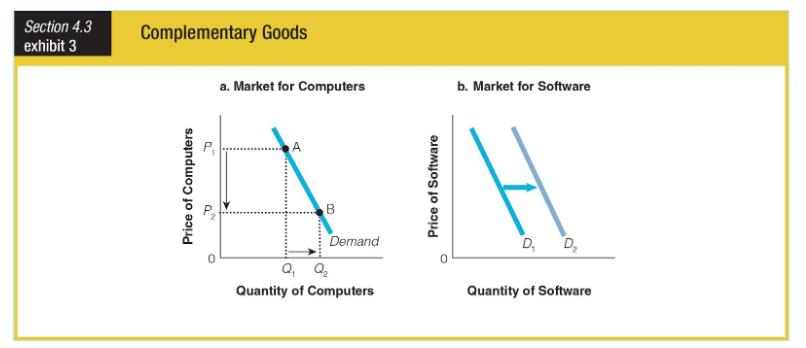

If the demand curve in graph B shifts to the right, which of the following most likely happened in Graph A?

a. Point B changed to Q2.

b. Q1 changed to Q2.

c. Point B changed to Point A.

d. P2 changed to P1.