The Capital Asset Pricing Model

A) is a way to formulate the cost of capital.

B) is a way to calculate the weighted cost of capital.

C) is a usual model for stock market investing.

D) none of these choices

A

You might also like to view...

The simplest money-creation multiplier is equal to

A) eD. B) H/e. C) 1/e. D) e/H. E) H/D.

The liquidity preference theory ________

A) distinguishes between nominal and real quantities B) shows that demand for real balances depends on real income C) shows that demand for real balances depends on the nominal interest rate D) all of the above E) none of the above

The supply curve does not:

A. represents producers' willingness and ability to sell. B. show the minimum price producers will accept for any given quantity. C. visually display the supply schedule. D. illustrate how consumers want to purchase goods and services.

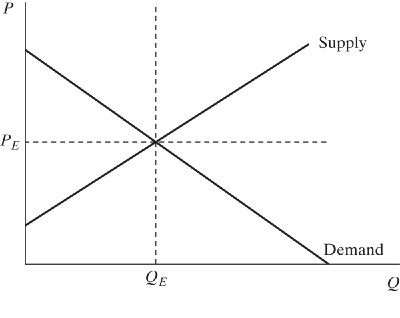

Figure 16.2Consider Figure 16.2, which depicts the supply and demand for coal. Assume coal production creates external costs. If the government imposes a pollution tax on coal production, the:

Figure 16.2Consider Figure 16.2, which depicts the supply and demand for coal. Assume coal production creates external costs. If the government imposes a pollution tax on coal production, the:

A. supply curve of coal would shift to the left. B. supply curve of coal would shift to the right. C. demand curve for coal would shift to the left. D. demand and supply curves for coal would shift to the left.