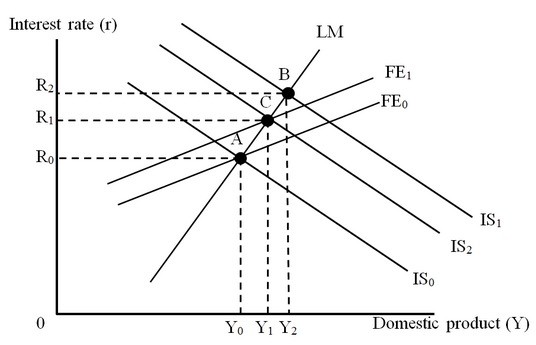

The figure below depicts the IS-LM-FE model with floating exchange rates. Following the shift of the economy from point A to point B, the shift of the IS curve from IS1 to IS2 was caused by

Following the shift of the economy from point A to point B, the shift of the IS curve from IS1 to IS2 was caused by

A. a worsening of international price competitiveness.

B. an improvement in the current account position.

C. official intervention in the foreign exchange market.

D. a contractionary monetary policy.

Answer: A

You might also like to view...

What, if any, is the impact of the CPI bias on government spending and taxes?

What will be an ideal response?

Suppose an industry is composed of 10 firms. Each firm's share of total sales in the industry is 10 percent. If two of the firms merge, then the four-firm concentration ratio in the industry will

A) remain unchanged. B) decrease as there are fewer firms in the industry. C) increase. D) depend on the market condition faced by the industry.

Comparative advantage is the ability to produce:

A. more of a good than others with a given amount of resources. B. relatively more than any other good with a given amount of resources. C. a good or service at a lower opportunity cost than others. D. more of a good at a lower cost.

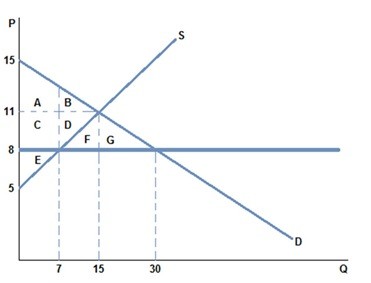

If a price ceiling of $8 were placed in the market in the graph shown:

If a price ceiling of $8 were placed in the market in the graph shown:

A. an excess supply of 23 would occur. B. an excess supply of 15 would occur. C. an excess supply of 7 would occur. D. None of these is true.