If a country with a relatively high inflation rate maintains a pegged exchange rate against the currency of a relatively low inflation country

A. its exports will become less competitive in the international market.

B. its currency will sell at a discount.

C. its currency will depreciate.

D. its exports will become more competitive in the international market.

Answer: A

You might also like to view...

A utility maximizing person gets marginal utility from consuming their last orange and apple of 5 and 10 respectively. If apples cost 90 cents a piece, the oranges must cost

a. $0.45 a piece. b. $0.90 a piece. c. $1.80 a piece. d. $2.70 a piece.

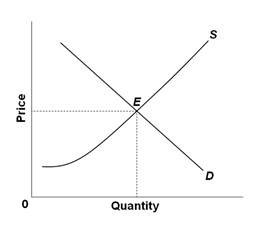

Refer to the graph below. Suppose that it is shows the market for an insurance product. If something happens to heighten the adverse selection problem in this market, then:

A. The supply curve will shift to the left

B. The supply curve will shift to the right

C. The demand curve will shift to the left

D. The supply curve will not be affected

The greatest threat to continued growth in the developed countries might be

A. low inflation rates. B. low interest rates. C. moderate marginal tax rates. D. restrictive regulatory policies.

The largest amounts of dollars spent on income transfers are for

A. Welfare programs. B. TANF. C. Social insurance programs. D. Unemployment insurance.