If the demand for a good is highly inelastic, a tax on the good

a. places the burden of the tax equally on buyers and sellers

b. permits sellers to pass most of the cost increase resulting from the tax on to the consumers of the product

c. reduces the profits earned by sellers since they must write the check to pay the tax

d. makes the demand more inelastic

e. makes the demand more elastic

B

You might also like to view...

The Japanese yen will appreciate against the dollar if

A) U.S. residents demand more Japanese goods. B) U.S. residents demand fewer Japanese goods. C) Japanese residents demand more U.S. goods. D) none of the above.

According to the text, which of the following is a principal reason why firms merge?

a. to form a cartel b. to exercise greater market control c. to increase their product differentiation d. to decrease their product differentiation e. to become a monopoly

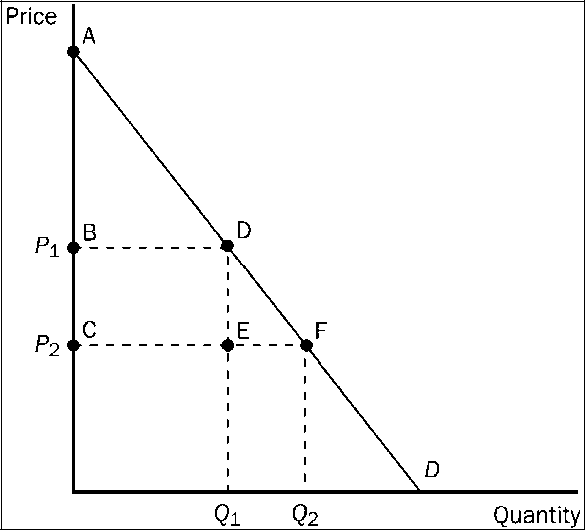

Figure 3-18

Refer to . Which area represents the increase in consumer surplus when the price falls from P1 to P2?

a.

ABD

b.

ACF

c.

DEF

d.

BCFD

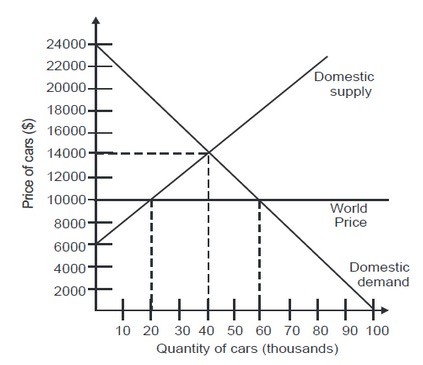

If this is an open economy, quantity of cars demanded domestically will be ________.

A. 40,000 B. 20,000 C. 80,000 D. 60,000