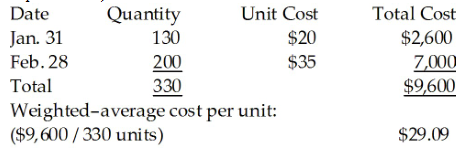

A company purchased 130 units for $20 each on January 31. It purchased 200 units for $35 each on February 28. It sold 200 units for $80 each from March 1 through December 31. If the company uses the weighted-average inventory costing method, calculate the amount of Cost of Goods Sold on the income statement for the year ending December 31. (Assume the company uses the perpetual inventory system. Round any intermediate calculations two decimal places, and your final answer to the nearest dollar.)

A) $9,600

B) $5,818

C) $2,600

D) $7,000

B) $5,818

Explanation:

Cost of Goods Sold = 200 units × $29.09 = $5,818

You might also like to view...

Which of the following is intensity in the motivation process?

A. what a person does B. how hard a person works C. how long a person works D. how smart a person works

A stereotype of Latin Americans is that they are polite and soft spoken

Indicate whether the statement is true or false.

In order to prepare a flexible budget:

a. the static budget must be prepared. b. estimated fixed and variable costs must be identified. c. the manager must estimate one level of activity. d. actual fixed and variable costs must be known. e. All of the answers are correct.

For the FTC to consider a practice to be unfair, it must meet a three-part test. Which of the following is NOT one of those tests?

a. The practice causes a substantial consumer injury. b. The harm of the injury outweighs any countervailing benefit. c. The consumer had no reasonable way to recoup lost funds from the injury. d. The consumer could not reasonably avoid the injury.