A company invested $400,000 in a technology that reduced the overall costs of production by reducing their cost per unit from $2 to $1.85 . Later, a manager has an opportunity to outsource production to another company at a cost per unit of $1.75 . If you are the manager, you

a. should consider the $400,000 as a sunk cost, not relevant to the decision

b. should reduce his effort by ignoring any new developments and letting the production run as it is.

c. should ignore the $400,000 fixed cost.

d. Both A & C

d

You might also like to view...

The concept of "wages" does not include which of the following items?

A. bonuses and royalties earned B. money spent by workers C. direct money payments, like salaries and commissions D. fringe benefits, like health insurance and paid leave

In Figure 3-7 above, if natural real GDP = $2500, AP = $250, and the change in "a" = change in I = change in NX = 0, the tax cut required to achieve then natural real GDP is

A) $312.50. B) $250.00. C) $500.00. D) none of the above.

A decrease in the marginal revenue product of land will: a. decrease the supply of land

b. increase the rental earnings from land. c. increase the price of land. d. decrease the demand for land.

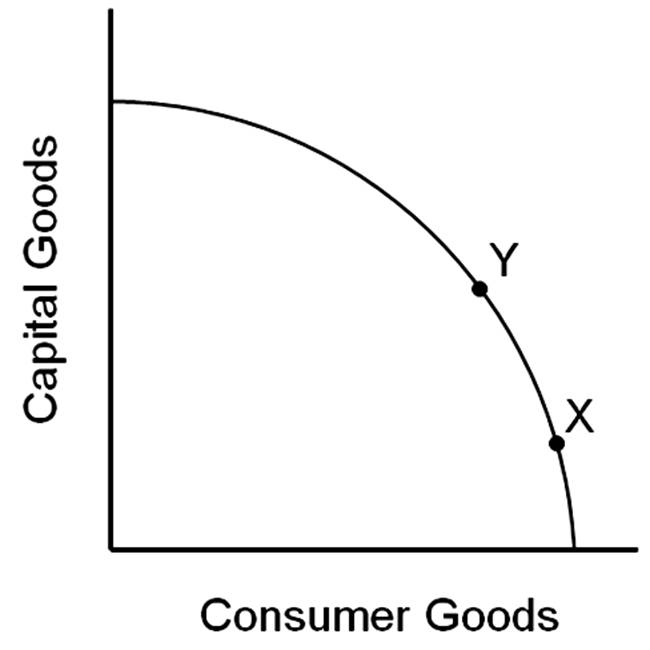

Imagine that a country is at point X of this production possibilities frontier and a country is at point Y.

A. The country at point X will probably grow faster than the country at point Y.

B. The country at point Y will probably grow faster than the country at point X.

C. The two countries will probably grow at about the same speed.

D. There is no way of predicting which country will grow faster.