Suppose a sales tax of $1 is imposed on DVDs. Suppose the tax causes the price received by suppliers of the DVDs to fall by 60 cents. In this situation, the economic incidence of the sales tax

a. falls more heavily on the demanders of DVDs.

b. falls more heavily on the suppliers of DVDs.

c. is evenly split between the demanders and suppliers of the DVDs.

d. is the same as the legal incidence of the tax.

b. falls more heavily on the suppliers of DVDs.

You might also like to view...

Using the data in the above table, if net exports = -$500 billion and the government balances its budget, then

A) the private sector must balance its budget. B) savings must equal $150 billion. C) the private sector runs a surplus of $850 billion. D) saving must equal $650 billion.

Neuroeconomics is a new field of economics motivated by the speculation that studying the human neural system can lead to:

A. a true mathematical model of utility theory. B. a unified theory of decision making. C. better laboratory experiments. D. tenure.

Less money supply

What will be an ideal response?

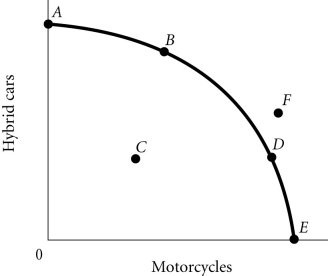

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point A necessarily represents

Figure 2.4According to Figure 2.4, Point A necessarily represents

A. only hybrid cars being produced. B. an unattainable production point. C. what society wants. D. the economy's optimal production point.