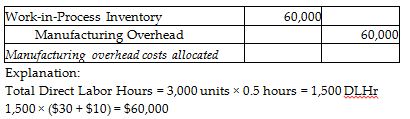

Myers Manufacturing uses a standard cost system. The allocation base for overhead costs is direct labor hours. Standard and actual data for manufacturing overhead are as follows:

Variable overhead allocation rate: $30 per direct labor hour

Fixed overhead allocation rate: $10 per direct labor hour

Actual overhead incurred (variable and fixed): $45,600

Standards for direct labor are as follows:

Hours per unit 0.5, Direct labor cost per hour $18.00

Actual direct labor for the month: 1,200 hours for a total cost of $24,000

Actual and planned production for the month: 3,000 units

Prepare the journal entry to allocate overhead cost (both variable and fixed) to production.

You might also like to view...

In seeking competitive advantage, the first law of business is to

A. take care of your shareholders. B. take care of your stakeholders. C. take care of the customer. D. take care of the environment. E. take care of your employees.

Which of the following taxes has a ceiling on the amount of annual earnings subject to tax?

A) FICA-OASDI taxes B) sales tax C) federal income tax D) FICA-Medicare taxes

It is typically easy to determine a precise mix of optimal debt and equity

Indicate whether the statement is true or false

The ________ effect is a form of self-fulfilling prophecy.

A. halo B. Drucker C. Stillman D. Pygmalion