Government regulations to insure the safety of bank deposits and to control the money supply include

a. limitations on the types and quantities of assets in which banks may invest.

b. elimination of the need for required reserves.

c. setting interest rate ceilings on savings and money market deposit accounts.

d. All of the above are correct.

a

You might also like to view...

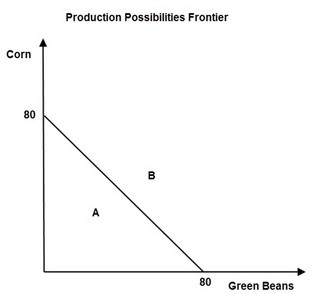

Use the following figure to answer the question below. The combination of sixty-five pounds of corn and sixty-five pounds of green beans is

The combination of sixty-five pounds of corn and sixty-five pounds of green beans is

A. attainable. B. not attainable. C. efficient. D. not efficient.

According to this Application, if you earn a salary of $40,000 in the first year and all prices triple in the next 10 years, what will your nominal annual salary be in 10 years?

A) $20,000 B) $60,000 C) $120,000 D) $180,000

If perfectly competitive firms exit a market, the

A) market supply curve shifts leftward. B) price of the good or service falls. C) profits of the remaining firms decrease. D) output of the industry increases.

Suppose the multiplier has a value that exceeds 1, and there are no crowding out or investment accelerator effects. Which of the following would shift aggregate demand to the right by more than the increase in expenditures?

a. an increase in government expenditures b. an increase in net exports c. an increase in investment spending d. All of the above are correct.