If at a given real interest rate desired national saving is $140 billion, domestic investment is $90 billion, and net capital outflow is $60 billion, then at that real interest rate in the loanable funds market there is a

a. surplus. The real interest rate will rise.

b. surplus. The real interest rate will fall.

c. shortage. The real interest rate will rise.

d. shortage. The real interest rate will fall.

c

You might also like to view...

Consumers and firms are known as price takers only if

A) no market exists to determine the equilibrium price. B) they can set the market price. C) they cannot unilaterally affect the market price. D) excess demand exists.

What could be a reason for a falling inflation rate?

a. Consumer optimism b. A negative spending shock c. Unemployment is below the natural rate d. An increase in oil prices e. A sudden increase in investment spending

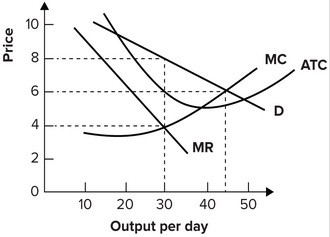

Refer to the graph shown. The maximum possible total profit this monopolist that charges only one price can earn is:

A. $240. B. $0. C. $120. D. $60.

In a perfectly competitive labor market, the least-cost combination rule for resource use

A. requires that the marginal physical product per dollar spent for each resource is equalized. B. assures the firm a normal profit. C. assures the firm an economic profit. D. requires that resources be used in combinations such that marginal products are equal.