The gold standard is a type of

A. floating exchange rate system.

B. flexible exchange rate system.

C. barter currency system.

D. fixed exchange rate system.

Answer: D

You might also like to view...

What does NOT appear on the asset side of a bank's balance sheet?

A. required reserves

B. checkable deposits

C. loans

D. excess reserves

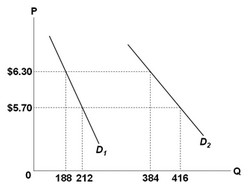

Use the following graph to answer the question.  Between prices of $5.70 and $6.30

Between prices of $5.70 and $6.30

A. D2 is more elastic than D1. B. D1 and D2 have identical elasticities. C. D1 is more elastic than D2. D. D2 is noncomparable to D1.

Targeting reserves would be the best choice if

A) there is a close and predictable relationship between bank reserves and total spending. B) there is an unpredictable relationship between bank reserves and total spending. C) the discount rate is fixed. D) private sector spending is very stable.

To separate the income and substitute effects, the imaginary budget line should be

A) tangent to the new indifference curve and parallel to the new budget line. B) tangent to the new indifference curve and parallel to the old budget line. C) tangent to the old indifference curve and parallel to the new budget line. D) tangent to the old indifference curve and parallel to the old budget line.