Complete the identity.tan (? - ?) = ?

A. -tan ?

B. cot ?

C. -cot ?

D. tan ?

Answer: A

You might also like to view...

Currently (on January 1, 2017), Nolan wants to have $45,000 available on December 31 2022 to purchase a luxury car. To be able to have this amount available, Nolan will make equal quarterly deposits for the next six years in an investment account earning a 16% annual return compounded quarterly. Nolan will make these deposits at the end of March, June, September, and December. What is the amount to be deposited quarterly for the next six years that will provide for a $45,000 balance at the end of 2022?

A. ?$1,875 B. ?$1,253 C. ?$1,151 D. ?$210

Solve the problem.Anna deposits $2500 in a savings account that compounds interest annually at an APR of 6% . Dave deposits $2600 in a savings account that compounds interest daily at an APR of 5.6%. After 10 years, who has more in their savings account and how much more do they have?

A. Dave has $104.82 more than Anna. B. Anna has $175.26 more than Dave. C. Anna has $88.14 more than Dave. D. Dave has $74.43 more than Anna.

Raymond's Leasing Company signed an agreement to lease an asset that has a fair value of $800,000 on December 31, 2014. The lease will be paid in seven equal annual payments of $138,730, beginning on December 31, 2014. The interest rate included in the lease agreement is most nearly equal to

A. 8%. B. 7%. C. 6%. D. 5%.

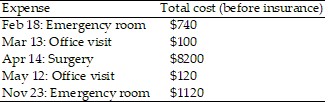

Answer the question.Assume that you have a health insurance plan with the following provisions:? Office visits require a copayment of $25? Emergency room visits have a $200 deductible (you pay the first $200)? Surgical operations have a $1200 deductible (you pay the first $1200)? You pay a monthly premium of $700During a one-year period, your family has the following expenses:  Determine your health-care expenses for the year with and without the insurance policy.

Determine your health-care expenses for the year with and without the insurance policy.

A. With policy $2350,without policy $10,280 B. With policy $9330,without policy $10,980 C. With policy $17,030,without policy $10,820 D. With policy $10,050,without policy $10,280