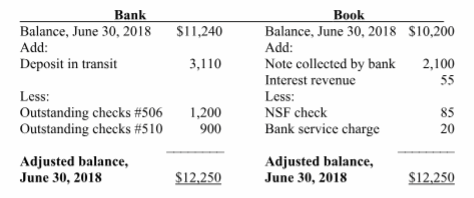

Refer to the following bank reconciliation:

Journalize the adjusting entry for the third reconciling item: NSF check. Omit explanation

You might also like to view...

For each of the items below, determine whether the items are temporary differences or permanent differences. Also, for each temporary difference, determine whether a deferred tax asset or deferred tax liability is created by the temporary difference described. Assume that each of the temporary differences described is an originating difference. Municipal bond interest

Accrued warranty expense Sales revenues received in advance Prepaid insurance where the tax deduction in future years will be less than the book expense Tax depreciation expense exceeds GAAP (book) depreciation expense Accrued bad debt expense The dividends received deduction Sales revenue recognized currently for GAAP, recognized for tax purposes in future years) Life insurance payments for executives for which the company is the beneficiary Fines paid for law violations What will be an ideal response?

Retailers are increasingly using a technique known as efficient consumer response (ECR) in an effort to work more closely with vendors on stock replenishment

Indicate whether the statement is true or false

Sally was recently assigned to an important advertising campaign for WonderCorp’s new project. She is usually the leader of cash operations and has not done any major advertising since she graduated from college three years ago. Sally is scared she might ruin the advertisement and create a bad name for the company. What is Sally’s reason for resisting change?

a. learning anxiety b. self-interest c. fear of loss d. uncertainty

A unique activity that adds value, expends resources, has beginning and end dates, and has constraints and requirements that include scope, cost, schedule performance, resources and value best defines

A) project. B) task. C) activity. D) job.