Assume that the central bank sells government securities in the open market. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the real GDP and reserve-related (central bank) transactions in the context of the Three-Sector-Model? State your answer after the macroeconomic system returns to complete equilibrium

a. Real GDP remains the same and reserve-related (central bank) transactions becomes more negative (or less positive).

b. Real GDP falls and reserve-related (central bank) transactions remains the same.

c. Real GDP and reserve-related (central bank) transactions remain the same.

d. Real GDP rises and reserve-related (central bank) transactions remains the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

In the short run in the Keynesian model, an increase in the domestic money supply would cause domestic output to ________ and the domestic real interest rate to ________

A) rise; rise B) fall; rise C) rise; fall D) fall; fall

Westland and Oceania have just started to trade with each other. Westland exports goods produced with skilled labor and imports goods made with unskilled labor from Oceania. Over time, we would expect that in Oceania the wages of unskilled workers will

a. rise, and the wages of skilled labor will fall. b. fall, and the wages of skilled labor will rise. c. rise, and the wages of skilled labor will rise. d. fall, and the wages of skilled labor will fall.

The precautionary demand for money is:

(a) An active balance. (b) Directly related to interest rates. (c) Negatively related to income. (d) An idle balance

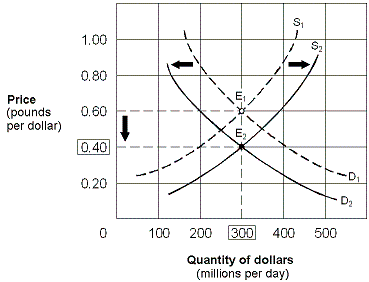

Exhibit 15-7 Foreign exchange market for U.S. dollars and British pounds

A. American goods become more popular in Great Britain. B. British incomes rise, while U.S. incomes remain unchanged. C. The U.S. price level rises, while the British price level remains unchanged. D. The U.S. real interest rate rises, while the British real interest rate remains unchanged.