A subprime mortgage loan is a loan granted to persons who

A) have unusually good credit ratings and who represent a very low risk of default on the debt repayment.

B) are borrowing funds to purchase a business, rather than a home.

C) might have low credit ratings or some other factors that lead lenders to believe that they could default on the debt repayment.

D) work for the government, rather than those who work in the private sector.

C

You might also like to view...

Marginal utility theory predicts that when income increases a

A) person's total utility will not change. B) person might increase the consumption of some normal goods and decrease the consumption of other normal goods. C) person's consumption of normal goods will increase. D) None of the above answers is correct because marginal utility theory does not address how demand changes in response to changes in income.

Why is portfolio diversification so important in international trade?

What will be an ideal response?

What is an entitlement?

What will be an ideal response?

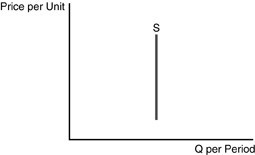

Refer to the above figure. The supply curve is

Refer to the above figure. The supply curve is

A. perfectly elastic. B. perfectly inelastic. C. elastic at high prices and inelastic at low prices. D. unitary for all prices.