The Big Tradeoff

What will be an ideal response?

Between efficiency and fairness

You might also like to view...

Suppose that in Canada the government places a $1,500 tax on the buyers of new snowmobiles. After the purchase of a new snowmobile, a buyer must pay the government $1,500. How would the imposition of the tax on buyers be illustrated in a graph?

A) The tax will shift both the demand and supply curves to the right by $1,500. B) The tax will shift the demand curve to the left by $1,500. C) The tax will shift the supply curve to the left by $1,500. D) The tax will shift the demand curve to the right by $1,500.

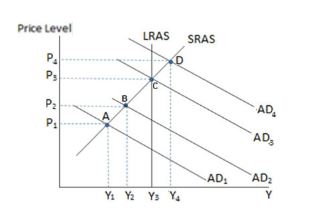

Assuming the economy is represented by the graph shown, if the government were to enact a partially successful expansionary fiscal policy, it would be most likely to:

A. move from equilibrium A to B.

B. move from equilibrium B to A.

C. cause unemployment to temporarily increase.

D. cause deflation.

_____, the lesser will be the effect of an increase in government spending on real GDP

a. The smaller the crowding-out effect b. The smaller the percentage of government spending financed by tax increases c. The larger the government budget surplus d. The more rapidly money is converted into goods e. The steeper the aggregate supply curve

The 60 percent rule states that __________________________.

Fill in the blank(s) with the appropriate word(s).