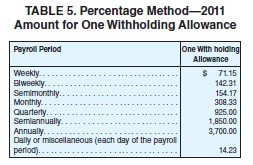

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $110,000 so far this year.

Carla LaFong has gross earnings of $7314.27 semimonthly. She is married and has 3 withholding allowances.

Carla LaFong has gross earnings of $7314.27 semimonthly. She is married and has 3 withholding allowances.

A. $8083.97

B. $5985.03

C. $5425.49

D. $6754.73

Answer: C

Mathematics

You might also like to view...

Decide whether the expression has been simplified correctly. 3 =

3 =

A. Yes B. No

Mathematics

Solve the equation for solutions in the interval [0, 2?).sin x cos x =

A. {0}

B.

C.

D.

Mathematics

Express the phrase as a ratio in lowest terms.2 yd to 8 ft

A.

B.

C.

D.

Mathematics

Solve.A survey of hourly wages stated that the hourly wages for an entry level worker for clerk's position were $8, $8, $11. Find the average hourly wage.

A. $9 B. $28 C. $27 D. $10

Mathematics