Explain why the bid-ask spread on most municipal bonds would be greater than the spread on U.S. Treasury bonds.

What will be an ideal response?

Spreads are the difference between the dealer's bid and asked prices. Since dealers are ready to buy or sell the bond, they must carry an inventory, which means they accept risk just like any other bondholder would. One of these risks is liquidity risk, which is the risk of not being able to sell the bond when you would like. Since the market for U.S. Treasury bonds is far more liquid than would be the market for any single municipal bond, the dealer of the municipal bond would face greater liquidity risk and require a larger spread.

You might also like to view...

You are in the business of producing and selling hamburgers, french fries, pizza, and ice cream. The mayor plans to impose a tax on one of these products

Based on the elasticities in the above table, as a profit-minded business person who seeks to avoid taxes whenever possible, which good would you least like to have taxed? A) hamburgers B) pizza C) French fries D) ice cream

Which of the following statements is TRUE about the optimal quantity of pollution?

A) It equals zero. B) Pollution abatement should continue up to the point where marginal cost equals the average total cost. C) Trade-offs exist between producing a cleaner environment and producing other goods and services. D) Firms should be allowed to determine the profit-maximizing amount of pollution abatement.

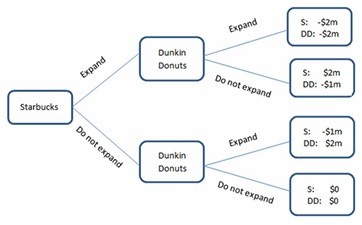

This figure displays the choices being made by two coffee shops: Starbucks and Dunkin Donuts. Both companies are trying to decide whether or not to expand in an area. The area can handle only one of them expanding, and whoever expands will cause the other to lose some business. If they both expand, the market will be saturated, and neither company will do well. The payoffs are the additional profits (or losses) they will earn.If the players in the figure shown act in their own self-interest, then we know that Dunkin Donuts will earn:

This figure displays the choices being made by two coffee shops: Starbucks and Dunkin Donuts. Both companies are trying to decide whether or not to expand in an area. The area can handle only one of them expanding, and whoever expands will cause the other to lose some business. If they both expand, the market will be saturated, and neither company will do well. The payoffs are the additional profits (or losses) they will earn.If the players in the figure shown act in their own self-interest, then we know that Dunkin Donuts will earn:

A. -$1 million. B. $0 million. C. -$2 million. D. $2 million.

Under the purchasing-power-parity theory, if a certain market basket of identical goods costs $10,000 in the United States and 2,500 euros in France, the exchange rate should be ______.

a. $1 to 1 euro b. $2 to 1 euro c. $3 to 1 euro d. $4 to 1 euro