If expected inflation were 4%, and the real interest rate was 5%, what sector would be worse off if the actual inflation rate turned out to be 3%

a. Lenders.

b. Borrowers.

c. Both.

d. None.

.B

You might also like to view...

A temporary decrease in the price of oil would be considered a:

A. long-run supply shock. B. demand shock. C. short-run supply shock. D. The changing price of oil would not affect any of these.

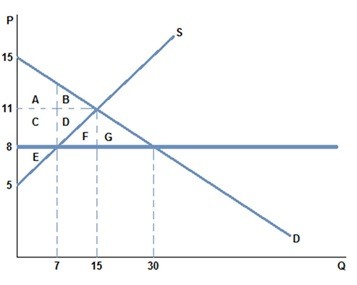

If a price ceiling of $8 were placed in the market in the graph shown:

If a price ceiling of $8 were placed in the market in the graph shown:

A. a shortage of 23 would occur. B. a shortage of 7 would occur. C. a shortage of 8 would occur. D. a shortage of 15 would occur.

Suppose that you open your own business and earn an accounting profit of $35,000 per year. When you started your business, you left a job that paid you a $30,000 salary annually. Also, suppose that you invested $70,000 of your own funds to start up your

business. If the normal rate of return on capital is 10 percent, your economic profit is A) $5,000. B) -$5,000. C) $2,000. D) -$2,000.

The graph above shows a small country that can import at the world price of Pw. Suppose that the government imposes a tariff of $T per unit (and suppose that this does not raise the domestic price so much that there will be no trade. Use the graph above to illustrate the effects of the tariff. Show the new areas of consumer surplus, producer surplus, and government revenue, and the deadweight

losses due to the tariff. Who wins and who loses from the tariff? What will be an ideal response?