Consider a system in which a person earning $10,000 pays $1,000 in taxes, a person earning $25,000 pays $2,000 . and someone earning $60,000 pays $4,000 . What type of tax is this?

a. progressive

b. proportional

c. regressive

d. property tax

e. one based on the benefits principle of taxation

C

You might also like to view...

When the market for a commodity is in equilibrium:

A) there will still be some unsold stock of the commodity. B) all sellers of the commodity will want to change their behavior. C) no economic agent will want to change his or her behavior. D) all buyers of the commodity will want to change their behavior.

If union demands result in a surplus of labor in some industries, the resulting

a. increased demand for labor in the nonunion sector drives nonunion wages up b. decreased demand for labor in the nonunion sector drives nonunion wages down c. increased supply of labor in the nonunion sector drives nonunion wages down d. increased supply of labor in the nonunion sector drives nonunion wages up e. decreased supply of labor in the nonunion sector drives nonunion wages up

Because resources are scarce, the opportunity cost of investment in capital is

A. infinite. B. forgone present consumption. C. zero. D. forgone future consumption.

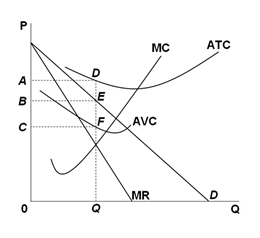

Refer to the graph below for a monopolist in short-run equilibrium. This monopolist has total cost equal to area:

A. CADF

B. 0ADQ

C. ADFC

D. 0CFQ