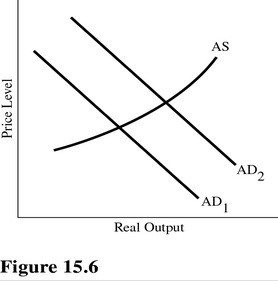

Refer to Figure 15.6. All of the following Fed actions are likely to increase the aggregate demand curve from AD1 to AD2 except

Refer to Figure 15.6. All of the following Fed actions are likely to increase the aggregate demand curve from AD1 to AD2 except

A. Raising the discount rate.

B. Lowering the federal funds rate.

C. Buying bonds in the open market.

D. Lowering the reserve requirement.

Answer: A

You might also like to view...

An option premium is

A) paid by the short to the long as soon as the option is purchased. B) paid by the long to the short as soon as the option is purchased. C) paid by the long to the short when the option is exercised. D) paid by the short to the long when the option is exercised.

A student entering college wants to assess the value of investing in human capital. To determine whether the investment will be profitable, she should compare the

a. value of her total expected future earnings with the total of her direct and indirect costs of college. b. present discounted value of future earnings with the total of her direct and indirect costs of her education. c. present discounted value of her additional future earnings as the result of the college education with the present discounted value of only her direct costs of college. d. present discounted value of her additional future earnings as the result of the college education with the present discounted value of her direct and indirect costs of college.

Suppose a banking system has $100,000 in deposits, a required reserve ratio of 25 percent, and total bank reserves for the whole system of $25,000. Then the potential increase in deposit creation for the whole system is equal to

A. $25,000. B. $0. C. $100,000. D. $50,000.

If in a fiscal year, the outlays > incomes

What will be an ideal response?