The Moonbeam Corporation produces most of the total output in its industry. The firm unilaterally lowers its price to less than average variable cost until a competitor leaves the market. This example highlights ______.

a. collusive oligopoly

b. perfect competition

c. predatory pricing

d. price discrimination

c. predatory pricing

You might also like to view...

Refer to Figure 21-6. The loanable funds market is in equilibrium, as shown in the figure above

An increase in the supply of loanable funds could result in which of the following combinations of the real interest rate and quantity of loanable funds at a new equilibrium? A) The real interest rate is 3 percent, and the quantity of loanable funds is $90 million. B) The real interest rate is 3 percent, and the quantity of loanable funds is $150 million. C) The real interest rate is 5 percent, and the quantity of loanable funds is $90 million. D) The real interest rate is 5 percent, and the quantity of loanable funds is $150 million.

Suppose there is a $20 million increase in government spending. We know that this increase in government spending will cause which of the following to occur?

A. equilibrium real GDP will increase by exactly $20 million. B. an increase in equilibrium real GDP and no change in the multiplier. C. an increase in equilibrium real GDP and a reduction in the multiplier. D. an increase in equilibrium real GDP and an increase in the multiplier.

Answer the following questions true (T) or false (F)

1. In absolute value, the tax multiplier is greater than the government purchases multiplier. 2. If government increases taxes by the same amount it increases government spending, there will be no effect on aggregate demand: the increase in government spending is offset by an equal decrease in consumption spending by households. 3. The tax multiplier is calculated as "one minus the government purchases multiplier."

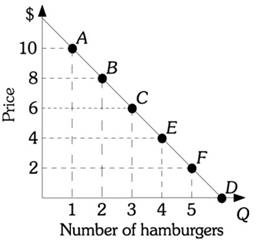

Refer to the information provided in Figure 5.2 below to answer the question(s) that follow. ?Figure 5.2Refer to Figure 5.2. If the price of a hamburger increases from $2 to $4, the price elasticity of demand equals ________. Use the midpoint formula.

?Figure 5.2Refer to Figure 5.2. If the price of a hamburger increases from $2 to $4, the price elasticity of demand equals ________. Use the midpoint formula.

A. -0.33 B. -2.0 C. -3.0 D. -5.0