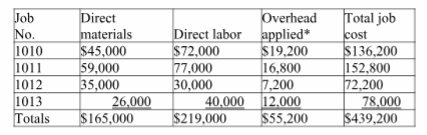

Calwell Corp. uses a job order costing system. Four jobs were started during the current year. The following is a record of the costs incurred:

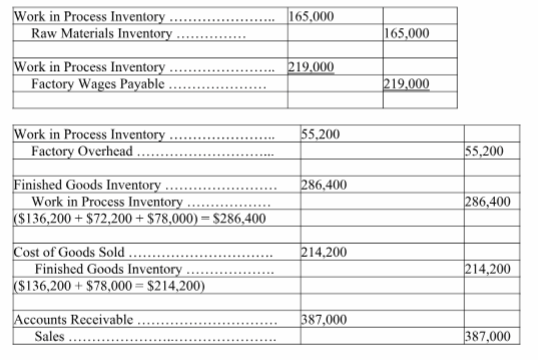

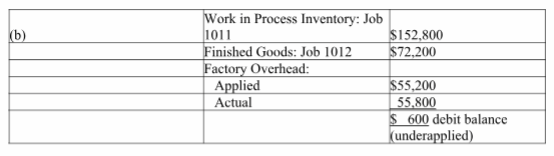

Actual overhead costs were $55,800. The predetermined overhead rate is $2.40 per direct labor hour. During the year, Jobs 1010, 1012, and 1013 were completed. Also, Jobs 1010 and 1013 were sold for $387,000. Assuming that this is Calwell's first year of operations:

(a) Make the necessary journal entries to charge the costs to the jobs started and to record the completion and sale of finished jobs.

(b) Calculate the balance in the Work in Process Inventory, Finished Goods Inventory, and Factory Overhead accounts. Does the Factory Overhead account balance indicate an over- or underapplied overhead?

Job 1010: 8,000 hours * $2.40/hour = $19,200

Job 1011: 7,000 hours * $2.40/hour = $16,800

Job 1012: 3,000 hours * $2.40/hour = $7,200

Job 1013: 5,000 hours * $2.40/hour = $12,000

You might also like to view...

All of the following are important provisions of the Sarbanes-Oxley Act except:

a. The establishment of a new Public Company Accounting Oversight Board. b. The requirement to prepare both FASB and IASB financial statements. c. A requirement that the external auditors report directly to the company's audit committee. d. A clause to prohibit public accounting firms that audit a company from providing any other services that could impair their ability to act independently in the course of their audit.

The internal monthly magazine and blog at the cosmetics firm Mary Kay serve as ________ for employees; the magazine and blog are outlets for not only selling advice but also company-wide recognition of individual salespeople's accomplishments.

A. salary increases B. nonfinancial rewards C. bonuses D. financial rewards E. commissions

The dollar amount that provides for covering fixed costs and then provides for operating income is called ________

A) variable cost B) total cost C) contribution margin D) margin of safety

The North American Industry Classification System (NAICS) permits a firm to

A. conduct an industry-wide SWOT analysis to determine internal strengths and weaknesses and external opportunities and threats of current and prospective competitors. B. engage in benchmarking with companies manufacturing and/or marketing similar products. C. find the NAICS codes of its present customers and then obtain NAICS-coded lists for similar firms. D. learn the names of the purchasing agents of all prospective customers. E. sell to any company within North America as long as it is not a monopoly.