Using the liquidity preference framework, what will happen to interest rates if the Fed increases the money supply?

What will be an ideal response?

The Fed's actions shift the money supply curve to the right. The new equilibrium interest rate will be lower than it was previously.

You might also like to view...

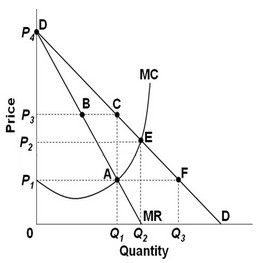

Use the following graph to answer the next question.  If the industry were served by a pure monopoly, the profit-maximizing price and quantity of output would be ________.

If the industry were served by a pure monopoly, the profit-maximizing price and quantity of output would be ________.

A. P1, Q1 B. P1, Q3 C. P3, Q1 D. P2, Q2

Which of the following is a true measure of national output?

a. GDP at market price b. Nominal GDP c. GDP in current dollars d. GDP in constant dollars

The slope of a budget line reflects the:

A. desirability of the two products. B. price ratio of the two products. C. amount of the consumer's income. D. utility ratio of the two products.

In a flexible exchange rate regime, an increase in the foreign interest rate (i*) will cause

A) the IP curve to shift to the left/up. B) the IP curve to shift to the right/down. C) a movement along the IP curve. D) neither a shift nor movement along the IP curve.