U.s. gaap

a. does not allow firms to amortize goodwill in measuring net income each period.

b. requires that an annual test for impairment in the value of goodwill be performed each period.

c. requires the write-down of goodwill and recognition of an impairment loss if an impairment in the value of goodwill exists.

d. all of the above

e. none of the above

D

You might also like to view...

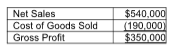

Calculate the gross profit percentage. (Round your answer to two decimal places.)

Danby, Inc. provides the following data from its income statement for 2018:

A) 18.42%

B) 64.81%

C) 100.00%

D) 35.19%

In India, the culture allows private and public aspects of the individual overlap. India would likely score high on ______ in Trompenaars' dimensions of value orientations.

A. diffuse B. affective C. specific D. neutral

When one is merging or being acquired, ________.

A. it is typically a quick and emotionless process B. it is typically concluded within a few weeks C. it can be an emotionally draining experience and take over a year D. None of these.

Carey decided to incorporate her business under the name yStar Inc Before yStar was incorporated, Carey signed a contract in the name of yStar, Inc to have some office space remodeled. Which statement is correct?

A)?yStar is liable on the contract because the contract was signed in its name. B)?yStar becomes liable on the contract as soon as it is incorporated. C)?yStar is liable on the contract if the contractor knows that the corporation does not yet exist. D)?yStar will be liable on the contract only if the corporation adopts the contract.