An excise tax on cigarettes

a. will cause both the market price and quantity to increase

b. will cause both the market price and quantity to fall

c. will cause the market price to rise and the market quantity to fall

d. will cause the market price to fall and the market quantity to rise

e. None of the above.

C

You might also like to view...

Capital is a flow of resources into the production of investment goods

a. True b. False Indicate whether the statement is true or false

Competitive price-taker firms respond to changing market conditions by varying their

a. price b. output c. market share d. information e. advertising campaigns

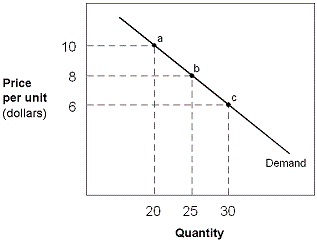

Exhibit 5-1 Demand curve

?

A. 0.67. B. 1.5. C. 2.0. D. 1.0.

Time lags mean that

A. fiscal policy is more effective than monetary policy. B. economic policy will be ineffective. C. monetary policy is more effective than fiscal policy. D. economic policy may be inappropriate when it takes effect.