On January 1, Jeff loans his friend Patrick $7,000 to buy a used car. Patrick signs a noninterest-bearing demand note. The applicable interest rate is 5%. Which of the following statements is correct?

A) Jeff has made a taxable gift to Patrick of $3,500.

B) Jeff must report interest income of $3,500 from Patrick.

C) Jeff has made a gift to Patrick that is not taxable since it is less than $11,000.

D) Interest does not have to be imputed on the gift since the loan amount is less than $10,000 and does not have a tax avoidance motive.

D) Interest does not have to be imputed on the gift since the loan amount is less than $10,000 and does not have a tax avoidance motive.

You might also like to view...

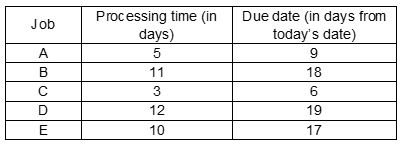

The makespan for the jobs listed in the following table under the earliest due date (EDD) rule is ______.

A. 41 days

B. 50 days

C. 40 days

D. 55 days

The ___________________________ Act forbids federal courts from issuing injunctions that interfere with the activities of unions such as strikes, payment of strike benefits, publicizing a dispute, peaceful picketing and unionization itself.

Fill in the blank(s) with the appropriate word(s).

Why is culture like an iceberg?

a) It is cold b) Many cultures are isolated c) Most of its mass is invisible d) Culture floats to the top of society

An end product is a(n) ______ whose demand is unrelated to the demand of any other product or item.

a. dependent demand item b. independent demand item c. variable demand item d. seasonal demand item