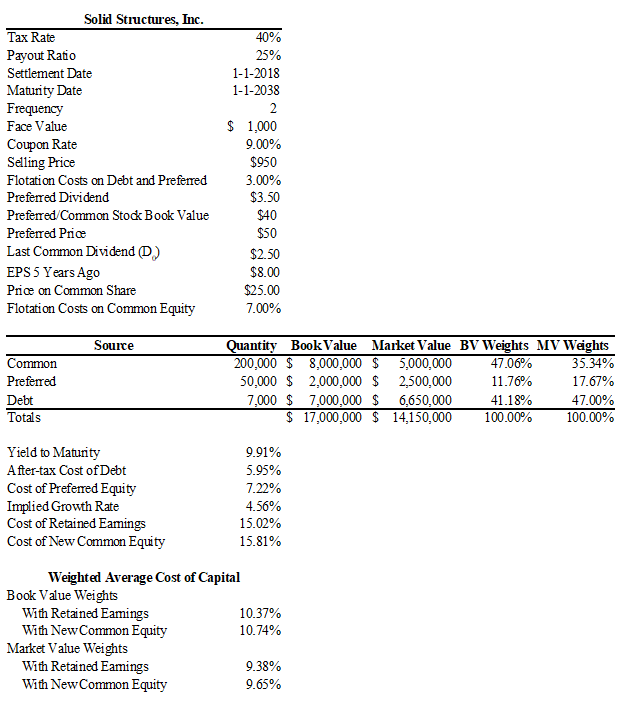

Solid Structures, Inc., a manufacturer of steel wire reinforcements and pre-stressed concrete strands for the concrete construction industry, wants to determine its WACC. Today, 1/1/2018, the firm issued 7,000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds will pay a 9% coupon rate semiannually and are currently selling for $950. The firm has 100,000 preferred shares of stock outstanding with a book value of $40, but currently selling for $50 per share. The most recent preferred and common dividends were $3.50 and $2.50 per share, respectively. The firm’s EPS five years ago was $8.00 and it expects to increase its next dividend payment by the implied 5-year earnings per share growth rate. Flotation costs on debt and preferred equity are both 3%, but 7% in the

case of common stocks. The common stock is selling today for $25 and the firm’s tax rate and payout ratio are 40% and 25%, respectively. The firm has 200,000 shares of common stock outstanding with the same book value as that of its preferred stock.

a) Calculate the book value and market value weights for each source of capital.

b) Calculate the component costs of capital (i.e., debt, preferred equity, retained earnings, and new common equity).

c) Determine the weighted average costs of capital using both the market and the book value weights.

You might also like to view...

A mixed costs line, plotted on a graph, will start at the Y axis at the amount of fixed cost

Indicate whether the statement is true or false

Which of the following is an example of a dual distribution system?

A) Walmart locating in several countries B) J.C. Penney's catalog and retail store sales C) Avon's door-to-door distribution D) Starbucks located inside a bookstore E) a hotel providing guest privileges at a nearby health spa

Putter Inc requires all capital investment projects to have a payback period of 4 years or less. Putter is currently considering an equipment purchase that has an initial cost of $80,000. The equipment is expected to have a six year life and a salvage value of $4,000. Assuming cash flows are equal, what does the annual cash flow generated by the equipment need to be in order to meet the payback

period requirements? A) $19,000 B) $13,333 C) $21,000 D) $20,000

Under Article 101(3) of the TFEU, the EU Commission granted block exemptions to:

a. vertical agreements. b. specialization agreements. c. research and development agreements. d. All of the above